What is a credit score and how can it be managed?

As one of the major credit information bureaus (CIBs) – and by virtue of our presence in several emerging markets where financial education is not yet mature – financial education remains a strategic priority for Creditinfo. We believe that financial education should be the cornerstone of a healthy financial ecosystem and that at the heart of this system should be a clear understanding of the mechanism and use of a credit score.

Although Creditinfo’s product range includes several types of scores, such as mobile score, recovery score, and propensity score; the traditional credit score is the most relevant for consumers in our core markets.

Credit scoring, a statistical indicator that shows a customer’s potential risk and the likelihood that their loan will be repaid – has proven its value in providing reliable and objective risk assessments, while reducing delinquencies, lowering operational costs, improving customer service quality and modernising the credit industry. Habituellement, les banques attribuent un score à un client comme partie du processus de la demande de prêt. This score, in the vast majority of cases, should determine, or help determine, the terms of the loan, including the interest rate, the timeframe, possible credit limits, etc. Understanding how a credit score works is a fundamental prerequisite for responsible management of personal finances as well as for being able to act proactively to improve the terms of current and future loans.

Why do lenders use credit scoring?

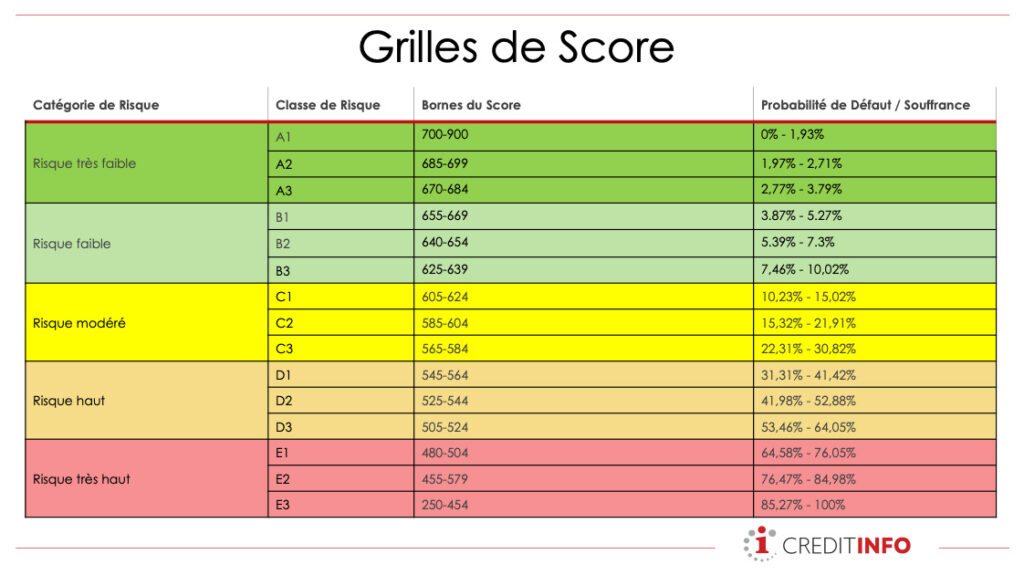

The first question a bank asks when presented with a loan application is: “How can we be sure we will see our money again? To answer this question, lenders compile a file on customers, which normally includes dozens and dozens of variables such as their age, employment, marital status, whether the customer has had any loans in the past and whether they have paid them back, etc. Then each variable is assigned “points”, and in this way, the customer’s creditworthiness is assessed. Then each variable is assigned “points”, and in this way a lender can view, in numerical terms, the payment behaviour and credit history of a customer. Usually, the scores range from 2/300-900, and the higher the score, the better the customer’s payment behaviour, and most likely, the better the loan terms.

Why should individuals/consumers care about their credit scoring?

It is also very useful for consumers to be able to decide whether to lend or not. Their objectivity and reliability, as well as the method of calculation, give consumers the possibility to have a real impact on their score. As the terms of loans depend heavily on the quality of the score, the incentive to be proactive is strong. Here are some simple steps consumers should take to improve and manage their credit score.

Table 1: Indicative illustration of risk classes, categories, and the corresponding probability of default. By using these indicators, it is much easier for lenders to make objective, data-driven decisions when granting a loan.

1. Accessing and monitoring your data

The first step is to access your personal data, and therefore your score. Like most BICs, Creditinfo offers a free annual Solvency Report to each client, where it is possible to consult credit history, score and other data. This is possible through the BIC websites, but also physically in the Creditinfo offices. The monitoring of this information is essential, because in this way consumers can verify the veracity of the data. The veracity of personal data in a credit file is critical, as mistakes (e.g. wrong repayment of a past loan) can have far-reaching consequences on the perception of your file by a bank. Monitoring personal data also helps to verify the benefits of “positive” payment behaviour, as well as to ensure that there is no fraudulent behaviour (e.g. identity theft) on your accounts.

2. Follow-up

In the unlikely event that you identify an error in your record, Creditinfo has a dispute/complaint resolution mechanism, where individuals can report inaccuracies/falsements after you have provided documentation to prove your claim. Creditinfo will contact you and the data provider (lender / bank / MFI) who was the source of the data and investigate and, if necessary, proceed to rectify the fault. Monitoring the evolution of your credit profile is an important step in the consolidation of your score.

3. Be good!

It may seem obvious, but “positive” payment behaviour pays well. Staying within your limits, paying your bills on time and other similar behaviours will go a long way to strengthening your payment history. Not crossing red lines is a good rule of thumb in general when managing your finances, but even more so if you are trying to improve your “score”. For example:

- Pay more than once during a monthly cycle, as this shows reliability and proactivity;

- Even if you only use them occasionally, don’t close credit cards, (so you don’t lose your “credit utilization ratio”)

- Don’t apply for new credit lines unless absolutely necessary!

4. And proactive!

The Solvency Reports also give indications as to the “weaknesses” of your case. This serves as a “guide” and an additional motivation to be proactive and take steps to directly address the weaknesses pointed out in the report. For its part, Creditinfo has a platform directly accessible by consumers, MyCreditinfo, which is a self-consumption portal where it is possible to access its reports. As mentioned, “better” scores normally lead to more favourable conditions for the consumer, so taking steps to improve one’s score is absolutely in the consumer’s interest.

5. Managing (also) your expectations

When it comes to improving your score, it is important to know that you will not make a change overnight. Isolated activities, however positive, will have only a marginal impact on your score. The key is consistent and regular “positive” behaviour, with the aim of building up your payment history. This can take anywhere from a few months to over a year. Lenders want to see consistent behaviour. They operate on the assumption that your “payment behaviour in the future will be like your behaviour in the past”, so demonstrating robust and continuous positive behaviour (which takes time) is the most important step you can take to improve your score.

Creditinfo Group

Creditinfo Group English

English